Cities Where Young People Are Struggling Most With Credit Card Debt

- Upgraded Points

A new analysis from Upgraded Points identifies where young adults are struggling most with severe credit card delinquency, analyzing the most recent data from the Federal Reserve Bank of Philadelphia. Researchers ranked U.S. metros and states by the share of credit cardholders ages 18 to 34 with credit card debt at least 90 days overdue in Q1 2025. The analysis also includes delinquency shares in Q1 2022, average credit card debt in each location, and how many young adults have exceptionally high credit utilization (over 75% of their credit limits).

Cities Where Young People Are Struggling Most With Credit Card Debt

Image Credit: Pormezz / Shutterstock

Credit cards used to be a convenience. Now they’re a necessity for millions of Americans relying on taking on debt for groceries, gas, and other daily essentials — all while facing the highest interest rates in decades and the lingering effects of historic inflation.

This financial pressure is especially acute for younger generations, who are navigating the early stages of their financial lives in a particularly unforgiving economic climate.

Younger Americans are more likely to overuse their credit cards and rack up lasting debt for several key reasons. They are earlier in their careers with less accumulated savings to fall back on, and they face a particularly challenging job market for entry-level workers. The fact that federal student loan payments have recently resumed has only compounded these financial challenges, squeezing monthly budgets even tighter. As a result, more and more young adults are delinquent on their credit card payments, according to the Federal Reserve Bank of Philadelphia, signaling a growing crisis for the nation's youngest adults.

To identify where these financial pressures are most intense, researchers at Upgraded Points — a company that provides advice on credit cards rewards programs and other financial products — analyzed the most recent data from the Federal Reserve Bank of Philadelphia. The study looks at credit cardholders ages 18 to 34 who have severely delinquent credit card debt and pinpoints the U.S. metropolitan areas and states where young people are struggling the most with credit card debt.

For the purposes of this study, card debt is considered severely delinquent after 90 days.

PormezzWorst Cities for Young Adult Delinquent Credit Card Debt

Memphis, Tennessee, ranks as the U.S. metropolitan area where young people are struggling the most with credit card debt. In Memphis, an alarming 27.5% of credit cardholders between 18 and 34 have severely delinquent accounts, nearly 7 percentage points more than the next closest large metro area. This struggle may be linked to the city's economic landscape, where the city grapples with one of the highest poverty rates among large U.S. cities.

In Atlanta, Georgia, where 20.8% of young adults are severely delinquent on their credit card payments, the cost of living is rapidly outpacing wage growth. As a major economic hub, Atlanta has experienced recent population growth, and its affordable housing has been unable to keep up. Though its job market remains robust, wages for many young adults may not be able to keep pace with housing costs.

Jacksonville, Florida, faces a similar dynamic, with 20.4% of its young cardholders in severe delinquency. The financial struggles among the city's young adults could be the result of the lingering housing affordability crisis partially caused by Florida's recent status as a top destination for migration. Though 2025 saw the Jacksonville housing market cool modestly, this comes on the heels of a long period of explosive growth.

The rest of the top 10 — including Las Vegas, Nevada (19.9%); Birmingham, Alabama (19.3%); Riverside, California (19.0%); Orlando, Florida (18.7%); Tucson, Arizona (18.1%); and Houston, Texas (18.3%) — are in the Sun Belt and largely grappling with stresses of population growth. The one outlier here is Cleveland, Ohio (18.0%), whose economy ranked in the bottom tier among U.S. metropolitan areas in terms of economic growth, according to the Milken Institute.

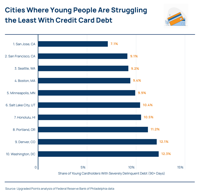

Best Cities for Young Adult Delinquent Credit Card Debt

At the other end of the spectrum, San Jose, California, stands out as the area where young people manage their credit card debt most effectively. In the heart of Silicon Valley, just 7.1% of cardholders 18 to 34 have severely delinquent accounts — a full 2 percentage points lower than the next-best-performing metro area. This financial health is likely a direct result of the region's high-wage economy, where the technology sector provides exceptionally high starting salaries that give young professionals a crucial buffer against the area's notoriously high cost of living.

Following closely are a pair of other major technology hubs: San Francisco, California (9.1%), and Seattle, Washington (9.2%). Much like in San Jose, the economies in these cities are dominated by high-paying industries in tech, finance, and biotechnology. While these metro areas are among the most expensive in the nation, the prevalence of 6-figure starting salaries for young, educated workers provides them with the financial means to cover high housing costs and other expenses without falling into severe debt.

Boston, Massachusetts, ranks fourth, with a severe-delinquency rate of 9.4%. The city's strong performance can be attributed to its elite concentration of universities and a diversified, knowledge-based economy focused on health care, education, and finance. This creates a robust job market for recent graduates with strong earning potential, allowing them to navigate the city's high cost of living more successfully than their peers in other regions.

The remaining cities where young people struggle least with severely delinquent credit card debt — including Minneapolis, Minnesota (9.9%); Salt Lake City, Utah (10.4%); Honolulu, Hawaii (10.5%); Portland, Oregon (11.2%); Denver, Colorado (12.1%); and Washington, D.C. (12.3%) — share a common theme. They are all characterized by dynamic, healthy job markets that offer young professionals strong opportunities and above-average wages. A notable member of this group is Minneapolis, which boasts an economy anchored by a high concentration of Fortune 500 company headquarters, providing stable, well-paying corporate career paths for its young residents.

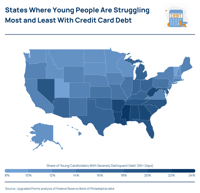

Young Credit Cardholders With Severely Delinquent Debt by State

At the state level, the trends in credit card delinquency largely mirror the patterns seen in the analysis of metropolitan areas. The states where young people are struggling the most are overwhelmingly concentrated in the South and the broader Sun Belt region. Mississippi leads the nation with nearly 24% of its young cardholders in severe delinquency, followed closely by Louisiana, Arkansas, Alabama, Georgia, and West Virginia, which all have rates above 21%. This regional pattern suggests that widespread economic challenges, including lower median household incomes and fewer high-paying career paths for young adults, contribute to greater financial instability and make young people rely more on credit card debt.

Conversely, the states with the lowest rates of severe delinquency are a more diverse mix, representing several different regions across the country. Utah and Vermont have the best outcomes, with delinquency rates of just 9.1% and 9.3%, respectively. Other top-performing states include Minnesota, Wisconsin, Washington, and Idaho. This variety indicates that there is no single path to financial stability for young people; it can be achieved in states with high-wage, knowledge-based economies as well as in states with more modest costs of living balanced by stable job markets and opportunities for growth.

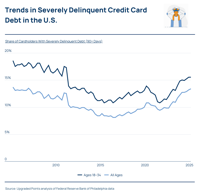

Change in Severely Delinquent Credit Card Debt Over Time

While these geographic disparities are stark, they are all part of a broader national trend: The financial strain on young Americans is growing at an alarming rate. After reaching a historic low in 2021 — largely thanks to pandemic-era stimulus and student loan forbearance — the share of young adults cardholders with severely delinquent credit card debt has sharply reversed course, climbing by nearly 5 percentage points in less than 4 years. While delinquency has risen across all age groups, the problem is consistently more acute for the young adult demographic, whose rate of severe delinquency remains more than 2 percentage points higher than the average for all adults.

For a complete breakdown of credit card debt and severe delinquency among young adults, read the full analysis on Upgraded Points: Cities Where Young People Are Struggling Most With Credit Card Debt.

Methodology

Image Credit: Pormezz via Shutterstock

To determine where young people are struggling the most with credit card debt, researchers at Upgraded Points analyzed the latest data from the Federal Reserve Bank of Philadelphia’s Consumer Credit Explorer. The analysis looked at credit cardholders ages 18 to 34 and used their data to calculate the share of young cardholders with severely delinquent credit card debt in both Q1 2025 and Q1 2022, as well as their average credit card debt and the share of them utilizing over 75% of their credit limits. Credit card debt is considered severely delinquent after 90 days. For relevance, metropolitan areas were grouped into population cohorts: large (more than 1 million), midsize (350,000 to 1 million), and small (less than 350,000).

For complete results, see Cities Where Young People Are Struggling Most With Credit Card Debt on Upgraded Points.

PormezzOriginally published on upgradedpoints.com, part of the BLOX Digital Content Exchange.

Tags

Currently in Alexander City